I have just finished reading Mark Carney’s dense and fascinating book, Values: an Economist’s Guide to Everything that Matters, 456 pages of well-argued, interesting, but not necessarily riveting prose.

He first provides a well documented history of the connection between finance, currencies and value, where ‘value’ has two meanings: value (as in market value) and values (as in ethics, environmentalism, aesthetics, kindness…).

He then applies theory and experience (of which he has plenty, as governor of the banks of Canada, then England, as well as work in the private financial sector) to three current issues: how society reacted to COVID; how it dealt with the 2008-2009 financial meltdown; and how it is dealing with the climate crisis.

After this, he makes concrete suggestions about how key capitalist actors – corporations, banks and governments – can better align value with values as they confront the major crises of our time.

Below are three items that I take away from this book.

1- Mark Carney is an intelligent and thoughtful person

As an academic, I am biased towards writers: I wish more of our politicians would take the time to grapple with fundamental issues of value, society and governance!

Mark Carney has done this (and, incidentally, so has Christia Freeland): he has carefully identified core weaknesses in our current economic system, ‘core’ because they touch upon how value is defined, who benefits from growth, and who suffers from technological, climate and other changes.

He has also thought about how these weaknesses can be addressed, and makes high-level, but concrete, proposals in the book’s last section.

2- Mark Carney does not follow his own advice: it won’t be different this time

A nagging paradox runs through the book.

On page 167 – and elsewhere in the book – he states that one of the three lies of finance is that “it is different this time”.

He explains that “this misconception is usually the product of an initial success building into a blind faith”: bankers and other leaders always think things will be different this time, that this time risks will pay off or the bubble won’t burst … but they are always (eventually) proven wrong.

Fine. Yet the whole premise of the book is that capitalist and market processes will extract us from the climate crisis, the crisis of confidence in institutions, and the crisis of inequality … if only they are hedged in by institutions that reflect values of environmentalism and social responsibility.

To sum up the argument: capitalism, which has led us into our current crises, will lead us out of them.

How come? Does Mark Carney think it will be different this time?

3- Redistribution is equated with piracy

Another argument that runs throughout the book is that capitalism functions because there is the possibilty – for lucky and successful entrepreneurs – to gain material wealth. According to Carney, profit is a necessary and salutary motivator, provided it does not become too dominant.

Yet Carney cites, with approval, Douglass North, an economist who said that “if [the] institutional matrix rewards piracy (or, more generally redistributive activities) more than productive activities, then learning will take the form of learning to be better pirates” (p410).

It is of concern to me that Carney seems to equate redistributive activities – such as progressive taxation, healthcare, universal education, public goods ? – with piracy.

To be fair, elsewhere in the book Carney writes of the need for more equitable distribution of income, for a good education system, and so on.

But I sense inconsistent values: Carney’s adherence to the basic premise of capitalism (private ownership and wealth as key motivators of innovation and growth) is not in line with his belief in wider social welfare. He does not explain how capitalism, which is premised on private accumulation, can be squared with meaningful redistribution, without which capitalism will not ensure welfare for all.

As Trump, Bezos, Zuckerberg, Musk and others swan around destroying institutions, trust, the environment, justice, fairness and human decency, I see little evidence that redistribution is piracy: rather, capitalist wealth is piracy!

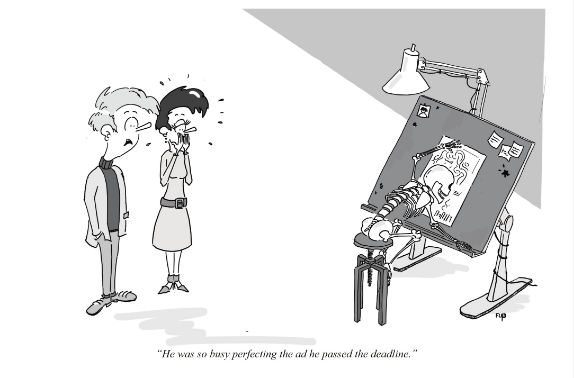

To conclude: perfection is the enemy of progress

It is necessary to think about how the current capitalist / market system can be replaced. The absolute excess displayed in the USA, the climate crisis, and capitalism’s perennial incapacity to prevent the obscene accumulation of wealth even as people die of hunger or under bombs sold for profit, strongly suggest that the capitalist system is broken.

Thus, in an absolute sense I do not share Mark Carney’s faith in capitalism, nor his belief that growth is necessary. Indeed, I find much of the de-growth and steady-state literature well-argued, setting out more convincing principles to guide society towards long-term, equitable and environmentally responsible, survival.

However, we are not going to overturn the capitalist system anytime soon, nor, I think, alter the growth mindset. In the meantime, Mark Carney, from within this system, presents a sound analysis and articulates how the system can be changed.

Indeed, should Carney’s agenda be followed, we won’t be too far from a de-growth scenario, because growth will have been redefined to value ecosystems, social trust, institutions and fairness.

As Carney himself says, sometimes we need to settle for second-best, since perfection is the enemy of progress.

One thought on “Mark Carney’s book: second-best Values”